If you’re researching captive insurance prior to a job interview, note that the information shown in this post is much more detailed than you’ll be expected to know for any entry-level roles in the offshore insurance or auditing sectors. That said, any insights you gain from reviewing this page will be useful…

A) Captives: cashflows

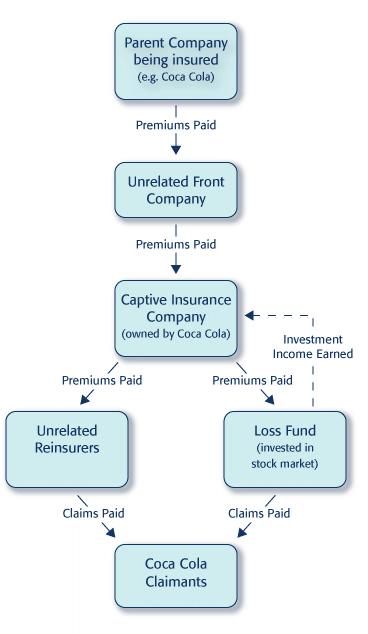

How it works:

- The parent, via a fronting company, pays its insurance premiums to its subsidiary captive, which has access to the reinsurance market where lower-cost insurance rates can be obtained

- The captive will decide how much of the claims risk to absorb for itself and will accordingly store some of the premiums received in its loss fund

- This loss fund invests such cash received in the stock market, earning investment income that is retained in the captive’s loss fund

- For the claims risk it does not wish to absorb in this way, it will purchase reinsurance cover of its own on the open market via unrelated reinsurers

- As and when retained claims are incurred by the parent company, these are settled using resources from the captive’s loss fund as planned

- By carefully controlling risk absorbed and claims paid, any profits that the captive makes can be returned to the parent company

- In such a way, an expense (insurance costs) can instead become a source of profits

B) Rent-a-captives: cashflows

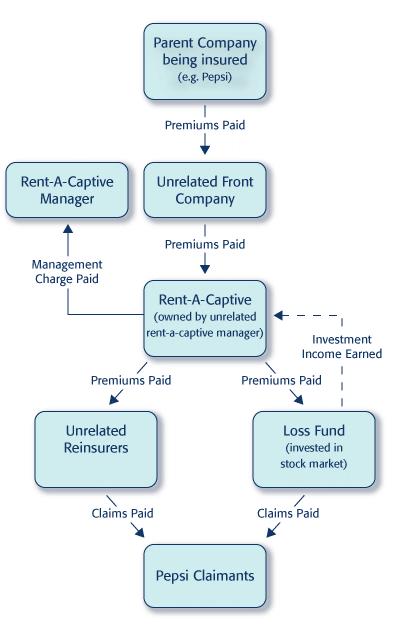

How it works:

- Cash flows for rent-a-captives are very similar to captives, the main difference being that instead of a dedicated subsidiary company being set up for each participant, a management company will set up a rent-a-captive company in which anyone can participate

- In effect, each participant owns a virtual slice of the captive, with ring-fenced loss funds, investment income and claims paid etc

- The management company will charge a fee to each of the participants, via the rent-a-captive, for the service provided

- Profits that the rent-a-captive earns can be returned to the participators as virtual dividends

See also: Introduction to Captives

If you are a lawyer or chartered accountant and interested in working in the Bermuda/Caribbean region, visit our jobs portal to see the latest vacancies. Our site also includes a downloadable All You Need to Know guide which will tell you all you need to know about living and working offshore.

![Enjoy All Your Bermuda Days [Video]](https://www.hamilton-recruitment.com/wp-content/uploads/2022/06/Parade-700x400-1-500x383.jpg)

![Bermuda Careers for Actuaries [Video]](https://www.hamilton-recruitment.com/wp-content/uploads/2022/03/Video-Actuaries-700x400-1-500x383.jpg)

Leave A Comment

You must be logged in to post a comment.