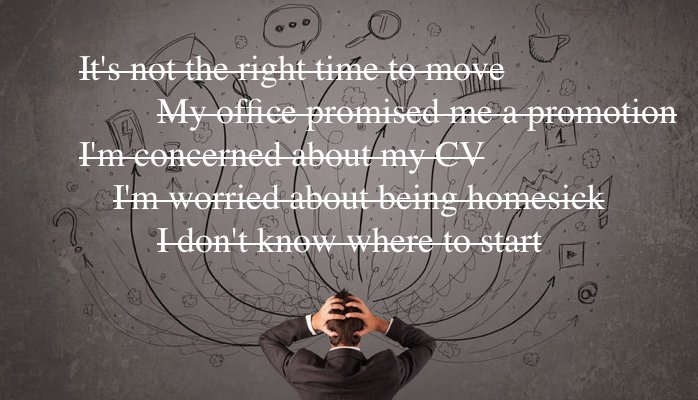

It’s perfectly normal to feel a degree of trepidation about taking a new step in your career. And for every candidate we see who tries something different, there are many others who make excuses to themselves and let opportunity pass them by. This is usually a way to rationalise fear of change.

However, most people – if they scratch below the surface of their fears – will realise that working abroad is a logical step to improving long-term career prospects. We’ve compiled a list of the 5 most common reasons not to apply cited by applicants. Let’s look at them…

1. It’s not the right time to move

For recently qualified chartered accountants, the ideal time is now.

It’s a chance to continue your post-qualification professional development in a desirable, world-class jurisdiction. Leave it a couple of years longer and, unless you are already working in financial services when you get round to applying, you’ll have missed the boat.

The exceptional opportunity offered offshore to gain access to the financial services sector opens doors that would otherwise remain out of reach for many – so it’s good for career progression.

In fact, our candidate survey shows that for the majority of applicants, future career advancement is by far the #1 reason you come to us.

That said, many people don’t do it just for the money and career experience: As soon as you step out of the office, you’re on vacation in the Caribbean. What more could anybody want?

2. My office promised me a promotion

Look at the managers in your office.

Without meaning to be unduly harsh, do they really have exceptional lives? Commuting, drudgery, taxes and bad weather. Were they unaware of the international choices available on qualifying, or perhaps afraid of taking a new step? You don’t have to live your life as they live theirs.

Even if the chance of a promotion does float tantalisingly on the horizon, staying put means forfeiting the international financial services experience that you’ll gain working in destinations such as the Cayman Islands and Bermuda.

And the local tax man will want his fair share of any promised pay award too.

You have a choice.

3. I’m concerned about my CV

This is easy. Compare two imaginary candidates:

Candidate A stays in the same job for two years after qualifying, moving up half a step each year, and works on the same clients as she has done for the last three years, ‘reinventing the wheel’ day after day for an extra 24 months of their life.

Candidate B qualifies and is headhunted to work overseas. He or she immediately benefits from international reporting experience, financial services industry training, fresh challenges with new clients, the development of new professional contacts around the world… and the leverage that a higher, tax-free salary affords in future contract negotiations.

Even better, with added experience of IFRS/US GAAP, the Islands are a useful route to a future move to the States (your financial services skills will be in great demand in New York), or a move to Hong Kong, London, Tokyo, Singapore or Melbourne… the list is endless. As a proven international professional, the world is truly your oyster, even after as little time as two busy seasons in audit.

Because you can offer future employers so much more, it’s not difficult to see that you’ll be in far greater demand afterwards.

4. I’m worried about being homesick

The unexpected thing about living abroad is that most people actually end up spending more quality time with their family and friends, not less. Why is this?

It’s simple. As soon as your friends and family know that you are moving to Bermuda or the Caribbean, you can bet they’ll be trying to figure out how soon they can come and stay with you. And when they do visit (or you go home), you’ll be spending a week or two of quality time together. That probably rarely happens at the moment outside of Christmas!

Plus it’s so easy to stay in touch these days with Skype and webcams, email, instant messenger services, Facebook, Twitter, SMS/texts and cheap international telephone calls. Keeping in touch with loved ones has never been as straightforward as it is now.

One of our candidates memorably said: “I’m not worried at all: It’s not like I’m moving to the moon or anything!” – We wholeheartedly agree.

5. I don’t know where to start

Start here. It’s not like jumping out of a plane without a parachute; in fact, it’s the total opposite. And it’s our job to make it easy for you.

Hamilton Recruitment will work with you to identify the job that best suits your requirements and meets your salary expectations. And we’ll ensure you are fully briefed on the company and the Island before you have an interview to make sure you’re fully prepared and stand the best chance of success.

Once you have found the right job, you have the comfort of knowing that you’ll be going to work for a blue-chip employer with a guaranteed package, which includes a tax-free income, sponsored work permit, free flights, paid vacation and full medical/insurance benefits.

On arrival, your employer will welcome you at the airport and arrange free accommodation for your first few weeks, giving you time to get settled. They often throw in use of a free car (or scooter in Bermuda) for the first few weeks too. And they’ll point you in the right direction when it comes to opening a local bank account, registering with a local doctor and finding somewhere to rent (perhaps by the beach, often sharing with other expat accountants).

Overseas offices are predominantly staffed with expats so employers can relate to what you go through as a fresh starter, and they will advise you from their own personal experience of knowing what it’s like to be new and the guidance you’re likely to need.

Short of having your bags packed for you, that’s all there is to it.

See also: Earn a Better Salary in Tax-free Bermuda & Cayman Islands

If you are a lawyer or chartered accountant and interested in working in the Bermuda/Caribbean region, visit our jobs portal to see the latest vacancies. Our site also includes a downloadable All You Need to Know guide which will tell you all you need to know about living and working offshore.

Leave A Comment

You must be logged in to post a comment.